10 Best Android Apps for Banking

Last Updated on May 18, 2024 by Jhonni Jets

In the digital age, mobile banking has become an integral part of our daily lives, offering convenience and accessibility like never before. With the rise of smartphones and the proliferation of mobile apps, traditional banking practices have undergone a remarkable transformation. Android, being one of the most widely used mobile operating systems, has a plethora of banking apps that cater to the diverse needs of users. From managing accounts and transferring funds to investing and budgeting, these apps have revolutionized the way we handle our finances. In this comprehensive article, we’ll explore the top 10 Android apps for banking, each offering a unique set of features and functionalities to streamline your financial life.

Whether you’re an avid mobile banking user or someone seeking to embrace the convenience of digital banking, these apps will empower you to take control of your finances with ease. From established financial institutions to cutting-edge fintech startups, these banking apps combine user-friendly interfaces, robust security measures, and innovative features to deliver a seamless and secure banking experience. Explore the world of mobile banking with confidence and unlock a new level of financial freedom with these top-rated Android apps.

Table of Content

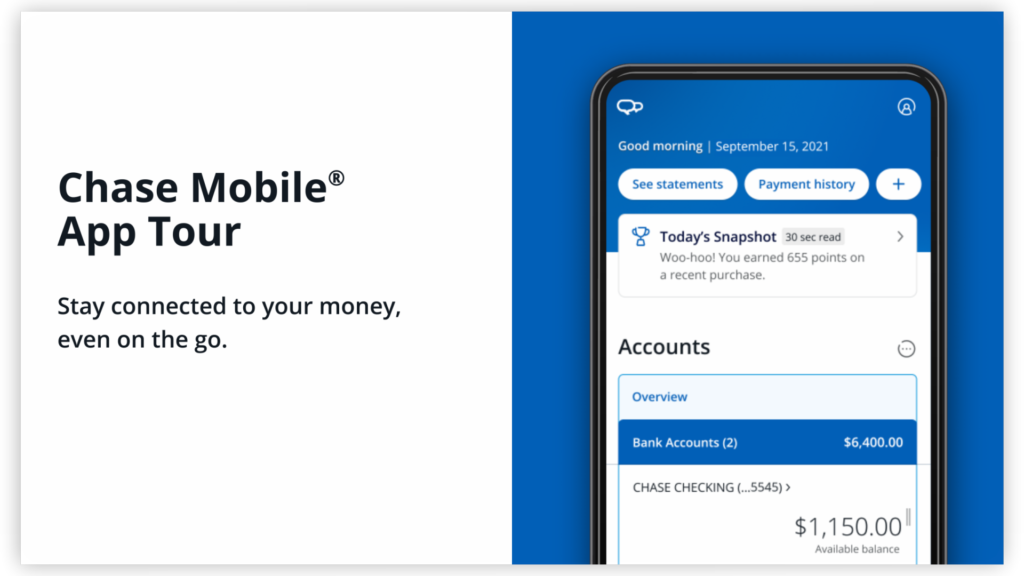

Chase Mobile: Seamless Banking from a Leading Financial Institution

Chase Mobile, the official app from JPMorgan Chase & Co., is a comprehensive banking solution that brings the power and convenience of Chase’s services to your Android device. With its user-friendly interface and robust features, Chase Mobile has become a go-to app for millions of customers.

One of the standout features of Chase Mobile is its account management capabilities. Users can easily check balances, view transaction histories, and transfer funds between their Chase accounts with just a few taps. The app also supports mobile check deposits, allowing users to securely deposit checks from the convenience of their smartphones.

In addition to banking features, Chase Mobile offers a range of financial management tools, such as budgeting tools, spending insights, and credit score monitoring. These features empower users to gain better control over their finances and make informed decisions.

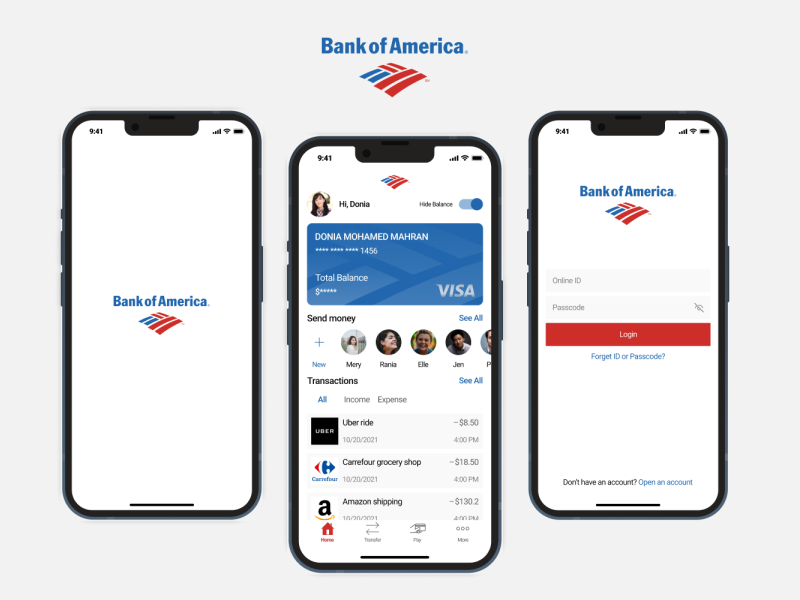

Bank of America Mobile Banking

Bank of America’s mobile banking app is a powerful and feature-rich solution that caters to the diverse needs of personal and business customers. With its intuitive design and robust security measures, this app provides a seamless banking experience for Bank of America account holders.

One of the key strengths of the Bank of America mobile app is its extensive range of features. Users can easily check account balances, view transaction histories, transfer funds, pay bills, and locate nearby ATMs or branches. The app also supports mobile check deposits and card management, allowing users to activate or replace their debit or credit cards with ease.

For business customers, the Bank of America mobile app offers dedicated features such as transaction approvals, payroll management, and cash flow analysis tools. These features enable business owners and managers to stay on top of their financial operations while on the go.

Wells Fargo Mobile

Wells Fargo Mobile is a comprehensive banking app that offers a wide range of features and functionalities to meet the diverse needs of personal and business customers. With its robust security measures and user-friendly interface, this app provides a seamless banking experience for Wells Fargo account holders.

One of the standout features of Wells Fargo Mobile is its account management capabilities. Users can easily check balances, view transaction histories, transfer funds between accounts, and set up recurring transfers or bill payments. The app also supports mobile check deposits, allowing users to securely deposit checks from the convenience of their smartphones.

For business customers, Wells Fargo Mobile offers dedicated features such as expense tracking, invoice management, and cash flow analysis tools. These features enable business owners and managers to streamline their financial operations and gain valuable insights into their financial performance.

Capital One Mobile

Capital One Mobile is a powerful and user-friendly banking app that has gained a loyal following among personal and business customers. With its intuitive design and innovative features, this app offers a seamless banking experience tailored to the modern user’s needs.

One of the standout features of Capital One Mobile is its intelligent assistant, Eno. This virtual assistant uses conversational AI to help users manage their finances, answer questions, and provide personalized insights and recommendations based on their spending patterns and financial goals.

In addition to account management features like balance checking, transaction viewing, and fund transfers, Capital One Mobile offers robust budgeting and spending tracking tools. These tools allow users to categorize their expenses, set spending limits, and gain valuable insights into their financial habits.

Ally Mobile Banking

Ally Mobile Banking is a dedicated app from Ally Bank, a leading online-only bank known for its competitive interest rates and innovative banking solutions. This app provides a seamless and convenient way for Ally customers to manage their finances on the go.

One of the key features of Ally Mobile Banking is its remote check deposit capability. Users can securely deposit checks by simply taking a picture with their smartphone’s camera, eliminating the need for physical visits to a bank branch or ATM.

In addition to account management features like balance checking and fund transfers, Ally Mobile Banking offers a range of tools and resources to help users manage their finances more effectively. These include budgeting tools, spending insights, and financial calculators for mortgages, auto loans, and investment planning.

Venmo: The Social Payment App

While not a traditional banking app, Venmo has become a popular choice among millennials and Gen Z for its seamless peer-to-peer payment capabilities and social features. Developed by PayPal, Venmo offers a unique and user-friendly way to split bills, share expenses, and transfer money between friends and family.

One of the standout features of Venmo is its social feed, which allows users to share payment notes and emojis with their connections. This social aspect has made the app a hit among younger generations, adding a fun and interactive element to the otherwise mundane task of transferring money.

In addition to peer-to-peer payments, Venmo also offers a debit card, allowing users to make purchases and withdraw cash from ATMs using their Venmo balance. The app’s integration with popular messaging apps like iMessage and WhatsApp further enhances its convenience and accessibility.

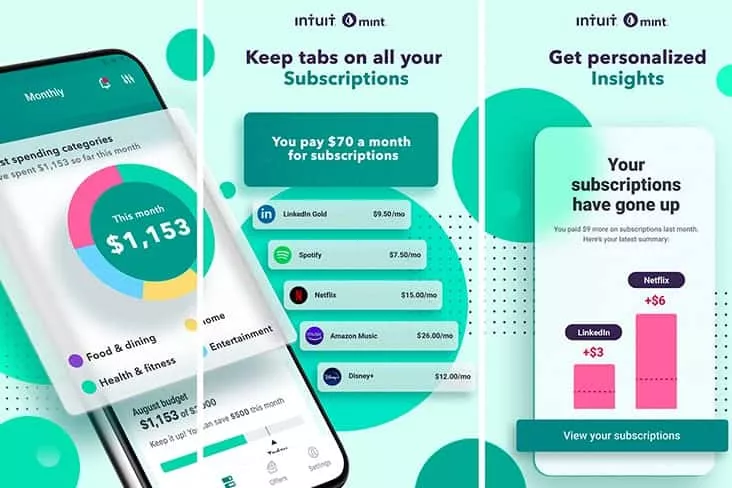

Mint: The All-in-One Personal Finance Manager

Mint is a powerful personal finance management app that goes beyond traditional banking features. Developed by Intuit, the creators of TurboTax and QuickBooks, Mint offers a comprehensive suite of tools to help users gain control over their finances.

One of the key strengths of Mint is its ability to aggregate and categorize transactions from multiple financial accounts, including bank accounts, credit cards, loans, and investments. This feature provides users with a holistic view of their financial situation, enabling them to track their spending, create budgets, and monitor their financial goals.

In addition to its financial tracking capabilities, Mint offers valuable features such as credit score monitoring, bill payment reminders, and personalized financial advice based on the user’s spending patterns and financial goals.

Simple: The Modern Banking Experience

Simple is a modern banking app that aims to simplify the way users manage their finances. With its clean and intuitive interface, Simple provides a refreshing approach to banking, catering to those who value transparency and convenience.

One of the standout features of Simple is its budgeting tools. The app allows users to create and manage multiple budgets, track their spending across categories, and receive real-time notifications when they’re approaching their budget limits. This feature helps users stay on top of their finances and make informed spending decisions.

In addition to budgeting tools, Simple offers features such as secure mobile check deposits, fee-free ATM access, and a unique feature called “Goals” that allows users to set aside money for specific savings goals, like a vacation or a new car.

Marcus by Goldman Sachs

Marcus by Goldman Sachs is a mobile banking app that offers a suite of personal finance products and services from the renowned investment bank. While not a traditional banking app, Marcus provides a convenient and user-friendly platform for managing savings accounts, personal loans, and other financial products.

One of the key features of the Marcus app is its high-yield online savings account. Users can easily open and manage their savings accounts, track their interest earnings, and set up automatic transfers from their linked checking accounts.

In addition to savings accounts, Marcus offers personal loans with competitive interest rates and flexible repayment options. The app’s intuitive interface makes it easy to apply for a loan, track the application process, and manage loan repayments.

Here’s the continuation of the article:

Robinhood: The Commission-Free Investment App

Robinhood is a popular investment app that has revolutionized the way people approach investing. While not a traditional banking app, Robinhood offers a unique and accessible platform for trading stocks, exchange-traded funds (ETFs), options, and cryptocurrencies, all without paying commission fees.

One of the standout features of Robinhood is its user-friendly interface and intuitive design, which makes it easy for beginners to start investing. The app provides real-time market data, customizable watchlists, and a variety of educational resources to help users make informed investment decisions.

In addition to its commission-free trading capabilities, Robinhood offers a range of other features, including fractional share investing, which allows users to buy portions of expensive stocks, and a cash management account that earns interest on uninvested funds.

Conclusion:

In the ever-evolving digital landscape, mobile banking has become an indispensable part of our daily lives. The top 10 Android apps for banking featured in this article offer a diverse range of features and functionalities to cater to the varying needs of users. From traditional financial institutions like Chase, Bank of America, and Wells Fargo, to innovative fintech solutions like Capital One Mobile, Ally Mobile Banking, and Venmo, these apps provide seamless and secure access to banking services.

Additionally, personal finance management apps like Mint and budgeting tools like Simple empower users to take control of their finances, track their spending, and achieve their financial goals. Apps like Marcus by Goldman Sachs and Robinhood offer unique investment opportunities, allowing users to manage their savings accounts, personal loans, and investment portfolios with ease.

As the world continues to embrace digital transformation, the demand for robust and user-friendly mobile banking solutions will only continue to grow. These top-rated Android apps not only streamline financial transactions but also provide valuable insights, personalized recommendations, and innovative features that enhance the overall banking experience.

Whether you’re an avid mobile banking user or someone looking to simplify your financial life, these apps offer a seamless and secure way to manage your finances on the go. Embrace the convenience and flexibility of mobile banking and unlock a new level of financial freedom with these top-rated Android apps.