10 Best Android Apps for Financial Management

Last Updated on May 17, 2024 by Jhonni Jets

In today’s fast-paced digital age, managing personal finances has become increasingly complex. From tracking expenses and budgeting to investing and retirement planning, staying on top of your financial affairs requires diligence and the right tools. Fortunately, the Android ecosystem offers a wealth of powerful and user-friendly financial management apps designed to simplify and streamline the process. In this comprehensive article, we’ll explore the top 10 Android apps that can revolutionize the way you manage your money, empowering you to take control of your financial future.

Mint: The All-in-One Financial Powerhouse

Mint is a widely acclaimed financial management app that offers a comprehensive suite of tools for budgeting, expense tracking, and credit monitoring. By securely linking your bank accounts, credit cards, and investment portfolios, Mint provides a centralized dashboard for monitoring your entire financial picture.

Table of Content

One of the standout features of Mint is its intuitive budgeting tools, which allow you to create customized budgets and receive alerts when you’re approaching your spending limits. Additionally, Mint offers valuable insights into your spending patterns, enabling you to identify areas where you can potentially save more money.

Personal Capital: Wealth Management at Your Fingertips

Personal Capital is a powerful financial management app designed for individuals seeking to take control of their investments and plan for long-term wealth growth. With its sophisticated investment tracking and analysis tools, Personal Capital allows you to monitor your portfolio performance, asset allocation, and investment fees, empowering you to make informed decisions about your investment strategy.

In addition to its investment management capabilities, Personal Capital also offers features for budgeting, expense tracking, and retirement planning, making it a comprehensive solution for managing your overall financial well-being.

YNAB (You Need a Budget): Revolutionizing Budgeting

YNAB (You Need a Budget) is a unique and highly effective budgeting app that takes a proactive approach to financial management. Unlike traditional budgeting methods that focus on tracking past spending, YNAB encourages users to give every dollar a job, allocating funds to specific categories before they’re spent.

With its user-friendly interface and powerful budgeting tools, YNAB helps you gain complete control over your finances by prioritizing your spending and ensuring that your money is working towards your financial goals. The app also includes features for goal-setting, debt management, and accountability, making it an invaluable resource for anyone seeking to achieve financial stability and security.

Acorns: Effortless Investing for Beginners

Acorns is a revolutionary micro-investing app that makes it easy for beginners to start building their investment portfolio. By automatically rounding up your everyday purchases and investing the spare change, Acorns allows you to invest small amounts consistently, without the need for large lump sums.

In addition to its unique round-up feature, Acorns offers a range of diversified investment portfolios tailored to your risk tolerance and investment goals. The app also includes educational resources and tools to help you understand the basics of investing and make informed decisions about your financial future.

Spendee: Expense Tracking Made Simple

Spendee is a user-friendly expense tracking app that makes it easy to monitor your spending habits and stick to your budget. With its intuitive interface and customizable categories, Spendee allows you to categorize your expenses, set budgets, and receive notifications when you’re approaching your spending limits.

One of the standout features of Spendee is its ability to sync across multiple devices, ensuring that your financial data is always up-to-date and accessible from anywhere. The app also offers powerful reporting and analytics tools, enabling you to gain valuable insights into your spending patterns and identify areas for potential savings.

PocketGuard: Simplifying Cash Flow Management

PocketGuard is a comprehensive financial management app that focuses on helping you maintain a positive cash flow. By linking your bank accounts and credit cards, PocketGuard provides a real-time view of your income, expenses, and available funds, ensuring that you never overspend or miss important bill payments.

In addition to its cash flow monitoring capabilities, PocketGuard also offers budgeting tools, bill reminders, and insights into your spending habits. The app’s user-friendly interface and intuitive design make it an ideal choice for anyone looking to gain better control over their daily finances and avoid potential financial pitfalls.

Digit: Automated Saving for Effortless Financial Growth

Digit is a innovative financial management app that takes the hassle out of saving money. By analyzing your income and spending patterns, Digit automatically transfers small amounts of money from your checking account to a dedicated savings account, without the need for manual intervention.

The app’s intelligent algorithms ensure that the transfers are made at optimal times, minimizing the impact on your daily cash flow. Additionally, Digit offers features like automatic overdraft protection and the ability to set savings goals, making it a powerful tool for building an emergency fund or saving for specific financial objectives.

Mvelopes: Envelope Budgeting for the Digital Age

Mvelopes is a financial management app that brings the classic envelope budgeting system into the modern era. By creating virtual “envelopes” for various spending categories, Mvelopes helps you allocate your funds effectively and avoid overspending in specific areas of your budget.

One of the key advantages of Mvelopes is its ability to sync with your bank accounts, providing real-time tracking of your expenses and ensuring that your budgets remain up-to-date. The app also offers features like debt management tools, financial coaching, and customizable reporting, making it a comprehensive solution for anyone looking to gain better control over their finances.

Robinhood: Commission-Free Stock Trading

Robinhood is a popular stock trading app that has revolutionized the investment industry by offering commission-free trades. With its user-friendly interface and powerful trading tools, Robinhood makes it easy for both novice and experienced investors to buy and sell stocks, exchange-traded funds (ETFs), and options.

In addition to its commission-free trading capabilities, Robinhood also offers features like real-time market data, customizable watchlists, and educational resources to help you make informed investment decisions. The app’s seamless integration with mobile devices makes it a convenient choice for actively managing your investment portfolio on the go.

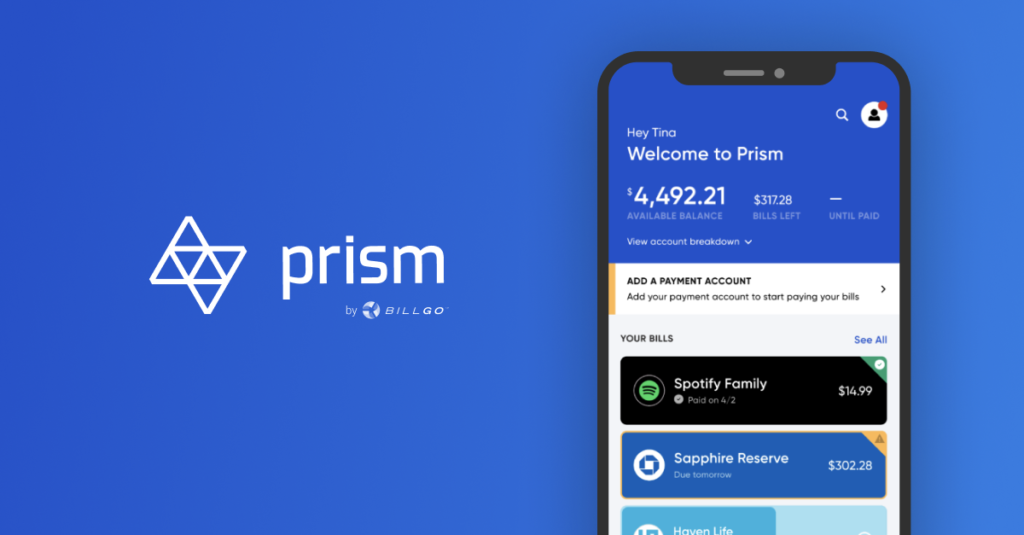

Prism: Streamlining Bill Management

Prism is a comprehensive bill management app that simplifies the process of tracking and paying your recurring bills. By linking your various accounts and service providers, Prism consolidates all your bills into a single, easy-to-navigate dashboard, eliminating the need to juggle multiple due dates and payment methods.

One of the standout features of Prism is its ability to set up automatic payments and reminders, ensuring that you never miss a payment or incur late fees. The app also offers budgeting tools and insights into your billing patterns, empowering you to better manage your monthly expenses and optimize your cash flow.

Conclusion

In the ever-evolving digital landscape, effective financial management has become increasingly crucial for achieving long-term financial security and peace of mind. By leveraging the power of Android apps specifically designed for budgeting, expense tracking, investing, and bill management, you can take control of your finances and make informed decisions that align with your financial goals.

Whether you’re seeking to improve your budgeting habits, build an investment portfolio, or streamline your bill payments, the apps featured in this article offer a diverse range of solutions to meet your unique needs. Embrace the benefits of these cutting-edge financial management tools and embark on a journey towards financial freedom and prosperity.