10 Best Android Apps for Tax Preparation

Last Updated on May 18, 2024 by Jhonni Jets

Tax season can be a daunting time, but with the right tools, it can be made much more manageable. For Android users, there are a plethora of apps available that can streamline the tax preparation process, making it easier to file accurately and on time. In this article, we’ll explore the top 10 Android apps for tax preparation, each offering unique features and benefits to help you navigate the complexities of tax filing with ease.

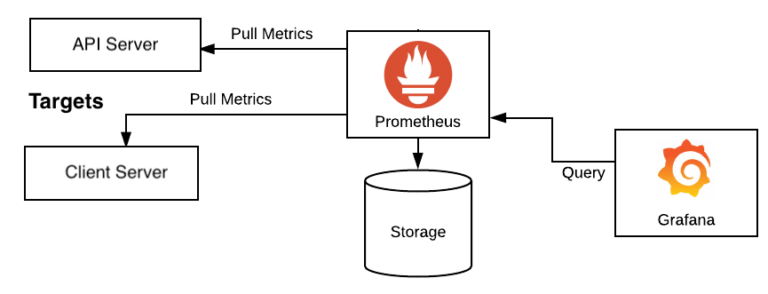

TurboTax Tax Return App: The Gold Standard for Mobile Tax Filing

Developed by Intuit, TurboTax is one of the most popular and trusted tax preparation apps in the market. With its intuitive interface and step-by-step guidance, TurboTax simplifies the tax filing process, ensuring that you don’t miss out on any deductions or credits. The app offers various versions to cater to different tax situations, including options for self-employed individuals, investors, and those with rental properties.

Table of Content

One of the standout features of the TurboTax app is its ability to import data from various sources, such as W-2 forms, investment accounts, and previous tax returns. This saves time and reduces the risk of errors. Additionally, the app provides real-time tax advice and explanations, ensuring that you understand each step of the process.

H&R Block Tax Preparation: Expert Guidance at Your Fingertips

H&R Block is another trusted name in the tax preparation industry, and their mobile app is a powerful tool for Android users. With its user-friendly interface and comprehensive tax interview, the app guides you through the entire process, ensuring that you don’t overlook any deductions or credits.

One of the key benefits of the H&R Block app is its extensive knowledge base, which provides detailed explanations and tax tips. The app also offers a range of filing options, including self-employment, investments, and rental income, making it suitable for a wide range of tax situations.

TaxSlayer: Simplifying Tax Filing for All Filers

TaxSlayer is a highly rated tax preparation app that offers a range of features at an affordable price point. The app is designed to be user-friendly, with a clean interface and step-by-step guidance that makes tax filing a breeze.

One of the standout features of TaxSlayer is its robust support system, which includes access to tax professionals who can assist you with any questions or concerns you may have. Additionally, the app offers a range of filing options, including self-employment, investments, and rental income, making it a versatile choice for various tax situations.

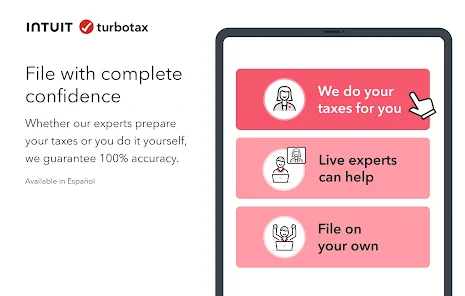

TaxAct: The Budget-Friendly Tax Preparation Solution

For those seeking a cost-effective tax preparation solution, TaxAct is an excellent choice. The app offers a range of filing options, including free federal and state filing for simple tax returns, making it an attractive option for individuals with straightforward tax situations.

Despite its budget-friendly pricing, TaxAct doesn’t compromise on features. The app provides step-by-step guidance, error checking, and access to tax professionals for additional support. It also offers a range of filing options, including self-employment, investments, and rental income, ensuring that it can cater to a wide range of tax situations.

Credit Karma Tax: Free Tax Filing Made Easy

Credit Karma, known for its credit monitoring services, also offers a free tax preparation app for Android users. The Credit Karma Tax app is designed to be user-friendly and accessible, making it an excellent choice for those with simple tax situations who want to file their taxes without any additional costs.

While the free version of the app is limited in terms of features, it still provides a straightforward tax filing experience, with step-by-step guidance and error checking. Additionally, the app offers access to tax professionals for those who require additional assistance.

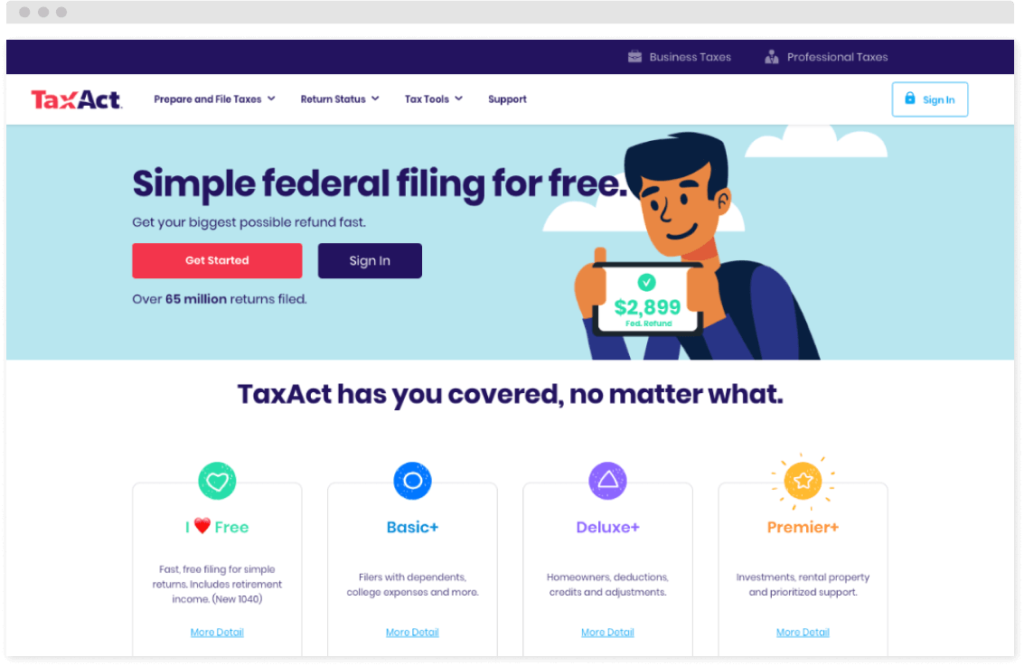

TaxCaster by TurboTax: Tax Planning Made Simple

While most tax preparation apps focus on the actual filing process, TaxCaster by TurboTax takes a different approach. This app is designed to help you plan and estimate your tax liability throughout the year, allowing you to make informed decisions and avoid any unpleasant surprises come tax season.

With TaxCaster, you can input your income, deductions, and other relevant information to get an accurate estimate of your tax liability. The app also provides personalized tax advice and tips to help you maximize your deductions and minimize your tax burden.

IRS2Go: The Official IRS App for Tax Information

While not a dedicated tax preparation app, IRS2Go is a must-have for anyone dealing with taxes. Developed by the Internal Revenue Service (IRS), this app provides access to a wealth of tax information, including tax tips, updates, and the ability to check your refund status.

IRS2Go also offers a range of useful tools, such as calculators for estimating tax payments and determining eligibility for various tax credits and deductions. Additionally, the app provides access to IRS publications and forms, making it a valuable resource for anyone navigating the complexities of the tax system.

Stride Tax: The Gig Worker’s Tax Companion

In the era of the gig economy, more and more individuals are taking on freelance and contract work. Stride Tax is an app designed specifically for gig workers, helping them navigate the unique tax challenges they face.

With Stride Tax, you can track your income and expenses, calculate your estimated tax payments, and even file your taxes directly through the app. The app also provides access to tax professionals who can answer questions and provide guidance specific to your situation as a gig worker.

MileIQ: Simplifying Mileage Tracking for Tax Deductions

For those who rely on their vehicles for work, tracking mileage can be a tedious but essential task for claiming tax deductions. MileIQ is an app that takes the hassle out of mileage tracking, automatically logging your trips and providing detailed reports for tax purposes.

With MileIQ, you can easily categorize your trips as business, personal, or commuting, ensuring that you only claim mileage deductions for eligible trips. The app also offers integration with popular accounting and tax preparation software, making it easy to import your mileage data during tax filing.

TaxCaster by TaxSlayer: Tax Planning Simplified

Similar to TaxCaster by TurboTax, TaxCaster by TaxSlayer is an app designed to help you plan and estimate your tax liability throughout the year. With its user-friendly interface and comprehensive tax calculations, TaxCaster by TaxSlayer takes the guesswork out of tax planning.

The app allows you to input your income, deductions, and other relevant information to get an accurate estimate of your tax liability. Additionally, it provides personalized tax advice and tips to help you make informed decisions and maximize your tax savings.

Conclusion:

Tax preparation can be a daunting task, but with the right Android apps, you can streamline the process and ensure accuracy and compliance. Whether you’re a self-employed individual, an investor, or have a simple tax situation, the apps listed in this article offer a range of features and benefits to cater to your specific needs. From robust tax filing solutions to mileage tracking and tax planning tools, these apps empower you to take control of your tax obligations and potentially maximize your deductions and credits. By leveraging the power of these Android apps, you can navigate the complexities of tax season with confidence and ease.