10 Best Android Apps for Budgeting

Last Updated on May 17, 2024 by Jhonni Jets

In today’s fast-paced world, effective budgeting is a crucial component of financial success. Whether you’re trying to save for a specific goal, pay off debt, or simply manage your monthly expenses more efficiently, having the right tools at your disposal can make all the difference. Fortunately, the Android ecosystem offers a wealth of powerful and user-friendly budgeting apps designed to simplify the process and help you take control of your finances. In this comprehensive article, we’ll explore the top 10 Android apps that can revolutionize the way you budget, empowering you to achieve your financial goals with ease and confidence.

Mint: The Budgeting Powerhouse

Mint is a widely acclaimed personal finance app that offers a comprehensive suite of tools for budgeting, expense tracking, and credit monitoring. With its intuitive budgeting features, Mint allows you to create customized budgets based on your income and spending patterns, making it easy to allocate funds to various categories and track your progress over time.

Table of Content

One of the standout features of Mint’s budgeting tools is the ability to link your bank accounts and credit cards, providing a seamless and automated way to categorize your expenses. Additionally, Mint offers valuable insights into your spending habits, enabling you to identify areas where you can potentially cut back and save more money.

YNAB (You Need a Budget): Proactive Budgeting Redefined

YNAB (You Need a Budget) is a unique and highly effective budgeting app that takes a proactive approach to financial management. Unlike traditional budgeting methods that focus on tracking past spending, YNAB encourages users to give every dollar a job, allocating funds to specific categories before they’re spent.

With its user-friendly interface and powerful budgeting tools, YNAB helps you gain complete control over your finances by prioritizing your spending and ensuring that your money is working towards your financial goals. The app also includes features for goal-setting, debt management, and accountability, making it an invaluable resource for anyone seeking to achieve financial stability and security.

PocketGuard: Effortless Cash Flow Management

PocketGuard is a comprehensive financial management app that focuses on helping you maintain a positive cash flow, which is essential for effective budgeting. By linking your bank accounts and credit cards, PocketGuard provides a real-time view of your income, expenses, and available funds, ensuring that you never overspend or miss important bill payments.

In addition to its cash flow monitoring capabilities, PocketGuard also offers budgeting tools that allow you to set spending limits for various categories and receive notifications when you’re approaching your budget limits. The app’s user-friendly interface and intuitive design make it an ideal choice for anyone looking to gain better control over their daily finances and avoid potential financial pitfalls.

Wally: Budgeting with a Personal Touch

Wally is a beautifully designed budgeting app that combines powerful features with a user-friendly and visually appealing interface. With Wally, you can easily create and customize budgets based on your unique financial situation, set spending limits, and track your expenses with a simple and intuitive expense logging system.

One of the standout features of Wally is its ability to categorize expenses automatically based on location data and merchant information, saving you time and effort in the budgeting process. The app also offers features like receipt scanning, financial reports, and the ability to sync data across multiple devices, making it a comprehensive solution for managing your budget on the go.

Mvelopes: Envelope Budgeting for the Digital Age

Mvelopes is a financial management app that brings the classic envelope budgeting system into the modern era. By creating virtual “envelopes” for various spending categories, Mvelopes helps you allocate your funds effectively and avoid overspending in specific areas of your budget.

One of the key advantages of Mvelopes is its ability to sync with your bank accounts, providing real-time tracking of your expenses and ensuring that your budgets remain up-to-date. The app also offers features like debt management tools, financial coaching, and customizable reporting, making it a comprehensive solution for anyone looking to gain better control over their finances through effective budgeting.

GoodBudget: Budgeting Made Simple

GoodBudget is a straightforward and user-friendly budgeting app that follows the principles of the envelope budgeting method. With its intuitive interface, GoodBudget allows you to create virtual envelopes for different spending categories and allocate funds accordingly, helping you stay within your budget and avoid overspending.

One of the standout features of GoodBudget is its ability to sync budgets across multiple devices, ensuring that your financial data is always up-to-date and accessible from anywhere. The app also offers features like transaction importing, recurring transactions, and the ability to share budgets with family members or partners, making it an ideal choice for couples or families looking to manage their finances together.

Spendee: Expense Tracking for Smarter Budgeting

Spendee is a user-friendly expense tracking app that can be a powerful tool for effective budgeting. With its intuitive interface and customizable categories, Spendee allows you to categorize your expenses, set budgets, and receive notifications when you’re approaching your spending limits.

One of the standout features of Spendee is its ability to sync across multiple devices, ensuring that your financial data is always up-to-date and accessible from anywhere. The app also offers powerful reporting and analytics tools, enabling you to gain valuable insights into your spending patterns and identify areas where you can potentially cut back and improve your budgeting efforts.

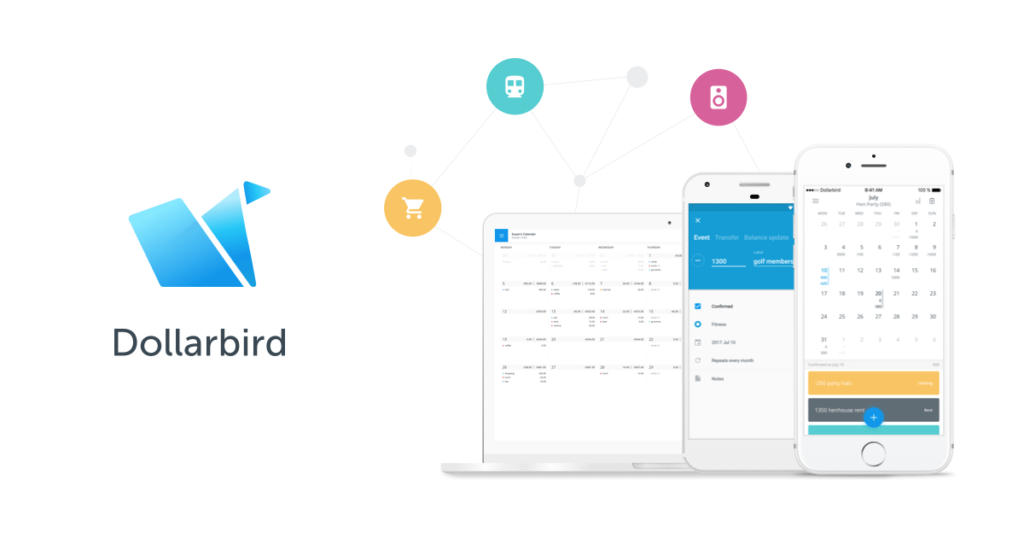

Dollarbird: Budgeting with a Calendar View

Dollarbird is a unique budgeting app that takes a calendar-based approach to financial management. With its intuitive calendar interface, Dollarbird allows you to visualize your income and expenses on a monthly or yearly basis, making it easy to plan and allocate funds for upcoming bills, recurring expenses, and financial goals.

One of the standout features of Dollarbird is its ability to handle irregular income streams, making it an ideal choice for freelancers, contractors, or anyone with variable income sources. The app also offers features like automatic transaction importing, budget tracking, and the ability to share budgets with others, making it a comprehensive solution for collaborative budgeting and financial planning.

Fudget: Budgeting with a Gamified Twist

Fudget is a budgeting app that takes a fun and engaging approach to financial management. With its gamified interface, Fudget encourages users to stick to their budgets by rewarding them with virtual achievements, badges, and progress bars.

In addition to its gamification elements, Fudget also offers powerful budgeting tools that allow you to create customized budgets, track expenses, and receive notifications when you’re approaching your spending limits. The app also includes features like financial reports, goal-setting, and the ability to sync data across multiple devices, making it a comprehensive solution for anyone looking to make budgeting a more enjoyable and rewarding experience.

Wallet: Budgeting with a Personal Finance Coach

Wallet is a comprehensive personal finance app that combines budgeting tools with a virtual financial coach. With its intuitive interface, Wallet allows you to create and manage budgets, track expenses, and receive personalized guidance and recommendations based on your financial situation.

One of the standout features of Wallet is its virtual financial coach, which uses machine learning algorithms to analyze your spending patterns and provide tailored advice on how to optimize your budgeting efforts. The app also offers features like automatic transaction categorization, financial goal-setting, and the ability to sync data across multiple devices, making it a powerful tool for anyone looking to take their budgeting skills to the next level.

Conclusion

Effective budgeting is a cornerstone of financial success, and with the abundance of powerful and user-friendly Android apps available, taking control of your finances has never been easier. From comprehensive budgeting solutions like Mint and YNAB to specialized apps like Mvelopes and Dollarbird, the apps featured in this article offer a diverse range of tools and approaches to meet your unique budgeting needs.

Whether you’re just starting your budgeting journey or looking to take your financial management skills to the next level, these Android apps provide the necessary features, insights, and guidance to help you achieve your goals. Embrace the benefits of these cutting-edge budgeting tools and embark on a path towards financial stability, freedom, and peace of mind.